Child Support

Child support is an offset between households for the benefit of the children and a common, by the book, feature of a parenting plan. Typically the home parent becomes the obligee, the person who receives child support, and the co-parent becomes the obligor, the person who pays child support.

Parties can agree on an amount of child support tailored to their specific circumstances and the needs of their children. This is a civilized way to do that, but there are many cautions that go along with this issue that are beyond the scope of this article.

QUESTION: If we have a 50/50 schedule or week on week off schedule that means no child support, right?

ANSWER: Wrong. The schedule is one of many factors and does not ipso facto cancel child support.

Trial courts have broad discretion to calculate and order payments for the support of a child. The law gives the court a formula as a guideline in calculating support. The resulting number is called “guideline child support” and is a common point of reference when beginning a negotiation on the issue, as that is what a court may do if the parties cannot prove or agree otherwise.

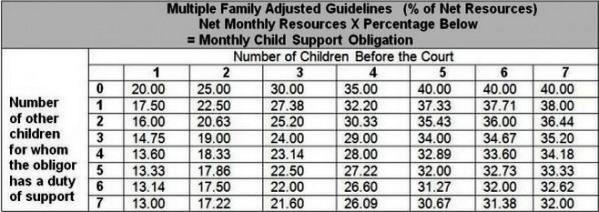

The operation of the guidelines is sterile and mathematical and requires tax returns, pay stubs, health insurance costs, a current statutory deduction table, and the obligor’s pay interval. Under links and forms I’ve posted a link to the Texas Attorney General’s online calculator if you’d like to eyeball it. Basically, use of the guidelines asks the court to identify the obligor’s monthly net resources and apply a percentage to it based on the number of children the obligor has, total. The resulting calculation is the guideline figure presumed to be in the best interest of the children. Guidelines are not the end of the story, though.

Here is a look at the percentage chart in the Family Code.

The courts are not bound by the guidelines and you are not limited in your negotiation to the guidelines as ironclad. In setting child support the courts take into account the unique circumstances of the parties and the children, the resources available for the support of the children, and above all else, the proven needs of the children. The statute sets forth a list of factors the trial court can consider, and you should consider to in your negotiation.

Sec. 154.123. ADDITIONAL FACTORS FOR COURT TO CONSIDER. (a) The court may order periodic child support payments in an amount other than that established by the guidelines if the evidence rebuts the presumption that application of the guidelines is in the best interest of the child and justifies a variance from the guidelines.

(b) In determining whether application of the guidelines would be unjust or inappropriate under the circumstances, the court shall consider evidence of all relevant factors, including:

(1) the age and needs of the child;

(2) the ability of the parents to contribute to the support of the child;

(3) any financial resources available for the support of the child;

(4) the amount of time of possession of and access to a child;

(5) the amount of the obligee's net resources, including the earning potential of the obligee if the actual income of the obligee is significantly less than what the obligee could earn because the obligee is intentionally unemployed or underemployed and including an increase or decrease in the income of the obligee or income that may be attributed to the property and assets of the obligee;

(6) child care expenses incurred by either party in order to maintain gainful employment;

(7) whether either party has the managing conservatorship or actual physical custody of another child;

(8) the amount of alimony or spousal maintenance actually and currently being paid or received by a party;

(9) the expenses for a son or daughter for education beyond secondary school;

(10) whether the obligor or obligee has an automobile, housing, or other benefits furnished by his or her employer, another person, or a business entity;

(11) the amount of other deductions from the wage or salary income and from other compensation for personal services of the parties;

(12) provision for health care insurance and payment of uninsured medical expenses;

(13) special or extraordinary educational, health care, or other expenses of the parties or of the child;

(14) the cost of travel in order to exercise possession of and access to a child;

(15) positive or negative cash flow from any real and personal property and assets, including a business and investments;

(16) debts or debt service assumed by either party; and

(17) any other reason consistent with the best interest of the child, taking into consideration the circumstances of the parents.

QUESTION: Our child is disabled and lives with me. Can I get child support after he turns 18?

ANSWER: Yes. A court can order support for an adult disabled child if the child, whether institutionalized or not, requires substantial care and personal supervision because of a mental or physical disability and will not be capable of self-support and the disability exists, or the cause of the disability is known to exist on or before the child’s 18th birthday.